Master Pegasystems PEGAPCDC87V1 Exam with Reliable Practice Questions

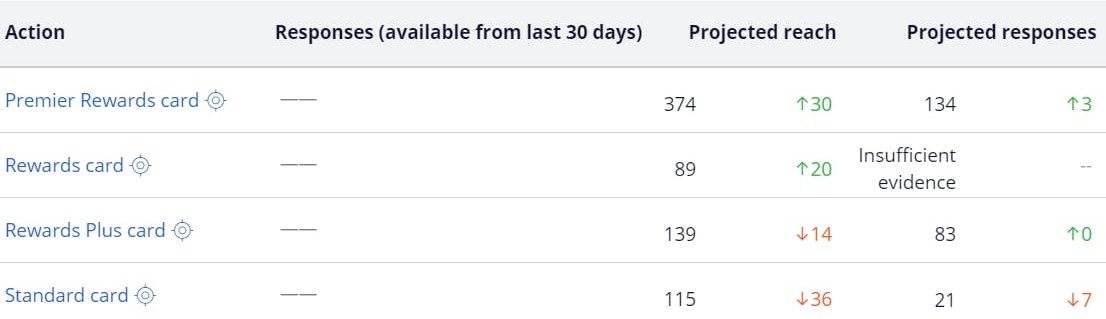

U + Bank, a retail bank, has applied business weight to their credit card offers to manually nudge the offers. The bank analyzes the effect of the change in Scenario Planner. The following image shows the projected reach and responses of the cards in the comparison mode. How many customers are likely to accept the Standard card?

Correct : A

Understanding the Scenario Planner Output:

The image shows the projected reach and projected responses for several credit card offers, including the Standard card.

The 'Projected responses' column indicates the number of customers expected to respond positively to each offer.

Interpreting the Data for the Standard Card:

For the Standard card, the 'Projected responses' is 21, with a change indicator showing a decrease of 7.

This decrease is factored into the projected response, meaning the expected number of positive responses after considering the applied business weight.

Step-by-Step Calculation:

The base projected responses for the Standard card is 21.

The decrease of 7 has already been factored into this projection.

Therefore, the number of customers likely to accept the Standard card remains 21, as it represents the final projected response after adjustments.

Verification from Pega Documentation:

The Scenario Planner in Pega Customer Decision Hub provides these projections to help visualize the impact of business weight adjustments and other lever changes on customer actions.

Start a Discussions

Reference module: Analyzing customer distribution using Pega Value Finder Which two of the following statements are true about Value Finder? (Choose Two)

Correct : A, D

Value Finder in Pega Customer Decision Hub identifies under-served customer segments and provides recommendations to optimize engagement policies. It helps in understanding how different customer groups are being served and suggests adjustments to engagement conditions to ensure a more inclusive and effective customer outreach.

Value Finder: Analyzing customer distribution and improving engagement strategies (Page 144-146)

Recommendations for loosening strict conditions to better serve customers (Page 147-148)

Start a Discussions

Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which mortgage offers are presented to qualified customers when the customers log in to the web self-service portal. As one of the offers is not performing well, the business wants to understand how many customers qualify for the offer. As a Decisioning Consultant, which simulation do you run to check how many customers qualify for an action?

Correct : D

To check how many customers qualify for a mortgage offer, you should run an audience simulation. Audience simulations help in testing engagement policies and understanding the eligibility of different customer segments for specific actions, allowing the business to gauge the reach and effectiveness of their offers.

Audience Simulation: Testing engagement policies and qualifying customers for actions (Page 137-139)

Using audience simulations to analyze offer performance (Page 140-141)

Start a Discussions

Reference module: Analyzing customer distribution using Pega Value Finder.

Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

Correct : C

Understanding the Requirement:

Myco wants to find new opportunities to improve marketing during the ideation stage of a project for presenting post-paid offers.

This involves identifying gaps and underserved customer segments that can be targeted with new or improved offers.

Pega Value Finder:

Pega Value Finder is designed to analyze the distribution of actions across different customer segments.

It helps identify customers who are not receiving any actions or are receiving only low-propensity actions, thus highlighting opportunities to improve the strategy.

Running the Simulation:

In Pega Value Finder, you can run simulations to discover underserved customers.

The tool provides insights into customer groups that are not well-engaged, allowing businesses to adjust their strategies and create more relevant actions or treatments.

Steps to Run Value Finder:

Log in to the Pega Customer Decision Hub portal.

Navigate to Discovery -> Value Finder.

Create a new simulation and select the relevant issue and group.

Run the simulation to analyze customer distribution and identify underserved segments.

Verification from Pega Documentation:

The Pega Customer Decision Hub User Guide details the process and benefits of using Value Finder to discover gaps and opportunities in customer engagement strategies.

Start a Discussions

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

Correct : C

With the volume constraints applied (75 maximum daily actions for StandardCard, 50 maximum daily actions for Email, and 50 maximum daily actions for SMS), the outbound run will deliver a total of 75 actions. This includes actions across different channels while adhering to the specified constraints.

Setting and applying volume constraints in outbound strategies (Page 45-46)

Understanding outbound channel processing and constraints (Page 29-30)

Start a Discussions