Master Pegasystems PEGACPDC88V1 Exam with Reliable Practice Questions

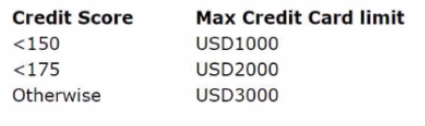

l)+ Bank uses Pega Customer Decision Hub to approve credit card limit changes requested by customers automatically. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank.

The bank wants to change the threshold value for the USD2000 credit limit from <175 to <200. How do you implement this change?

Correct : D

The scorecard model determines the customer credit score based on various factors, such as income, expenses, assets, liabilities, etc. The scorecard model has a Results tab where you can define the cutoff values for different segments based on the credit score. To change the threshold value for the USD2000 credit limit from <175 to <200, you need to change the cutoff value in the Results tab of the scorecard model. Changing the cutoff value in the scorecard decision component, changing the condition in the strategy, or mapping the score value in the decision strategy will not affect the credit score calculation or segmentation.

Start a Discussions

What does a dotted line from a "Group By" component to a "Filter" component mean?

Correct : C

A dotted line from a ''Group By'' component to a ''Filter'' component means that a property from the ''Group By'' is referenced by the ''Filter'' component. For example, if you group customers by age and then filter them by average spending, you need to reference a property from the ''Group By'' component, such as .pxSegment, in the ''Filter'' component. A dotted line does not indicate a one-to-one relationship, an evaluation order, or a copying of information between components

Start a Discussions

In a decision strategy, to use a customer property in an expression, you

Correct : B

In a decision strategy, to use a customer property in an expression, you need to define Customer page in Pages & Classes and specify its class as Data-Customer. This allows you to access customer properties by using dot notation, such as Customer.Age or Customer.Gender. You do not need to define the property as a strategy property, use it without any prefix, or prefix it with the keyword Customer. Verified Reference: [Certified Pega Decisioning Consultant | Pega Academy], Decision strategies

Start a Discussions

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

Correct : D

Using the decision table, you can find the label for a customer with a credit score of 240 and an average balance of 35000 by following these steps:

Start from the top row and check if the customer's credit score is less than 150. If yes, then the label is Very Poor. If no, then move to the next row.

Check if the customer's credit score is less than 175 and their average balance is less than 25000. If yes, then the label is Poor. If no, then move to the next row.

Check if the customer's credit score is less than 200 and their average balance is less than 50000. If yes, then the label is Fair. If no, then move to the next row.

Check if the customer's credit score is less than 250 and their average balance is less than 75000. If yes, then the label is Good. If no, then move to the last row.

The last row applies to all other cases that do not match any of the previous conditions. The label for this row is Very Poor.

In this case, the customer's credit score is not less than 150, so the first row does not apply. The customer's credit score is less than 175, but their average balance is not less than 25000, so the second row does not apply either. The customer's credit score is not less than 200, so the third row does not apply. The customer's credit score is less than 250 and their average balance is less than 75000, so the fourth row applies. Therefore, the label for this customer is Poor.

Start a Discussions

MyCo, a mobile company, uses Pega Customer Decision Hub to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what must you do to present offers from the two groups?

Start a Discussions