Master CIPS L5M2 Exam with Reliable Practice Questions

In which of the following industries is it common to find dedicated resource for risk management?

Correct : A

Banking and Insurance industries usually have a dedicated resource. This mean people working within the company are dedicated to this role (as opposed to using a third party). P. 146

Start a Discussions

Who takes ownership for a Business Continuity Plan?

Correct : A

A Business Continuity Plan is held at the top level. See p. 155

Start a Discussions

Which of the following statements is true about a Disaster Recovery Plan? Select TWO

Correct : B, D

Answers 2 and 4 are correct. A Business Continuity Plan is held at the top level, not a disaster recovery plan. This can be held at the department level- or whoever would have the ability to enact this if a disaster were to happen. A company is likely to have several Disaster Recovery Plans for different departments and different scenarios so several people within the organisation may be accountable for these. Option 3 is incorrect as the focus is on recovering systems (e.g. getting people back online) not on profit. P.155

Start a Discussions

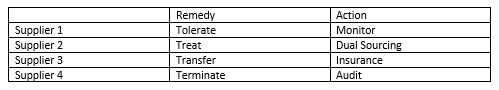

Which of the following will you put into box 2?

Correct : C

The correct answers are as follows:

Start a Discussions

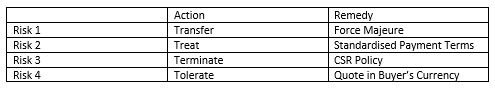

Which of the following will you put into box 2?

Correct : B

The correct answers are as follows:

Cashflow issues can lead to serious financial problems and the company going bust. Therefore this risk must be treated.

Start a Discussions