Master CIMAPRO19-P02-1 Exam with Reliable Practice Questions

One of an investment centre's products is sold on an external market. Output is limited because the specialist machine that manufactures the product is operating at full capacity.

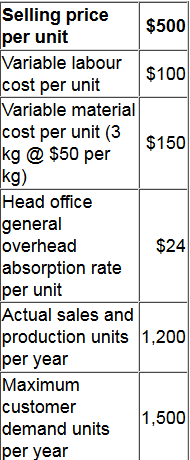

Current data for the product are as follows.

Investigations have identified that more rigorous maintenance of the machine at an annual cost of $5,000 would reduce the number of breakdowns and increase its capacity to 1,300 units per year.

There would be no change in the selling price if more units were sold. Any additional labor hours would be paid a premium of 25%. A discount of 2% of the cost of all materials purchased is available if the company increases its purchases to 3,700 kg or more per year.

What would be the increase in the investment centre's annual controllable profit if more rigorous maintenance is undertaken?

Correct : A

Start a Discussions

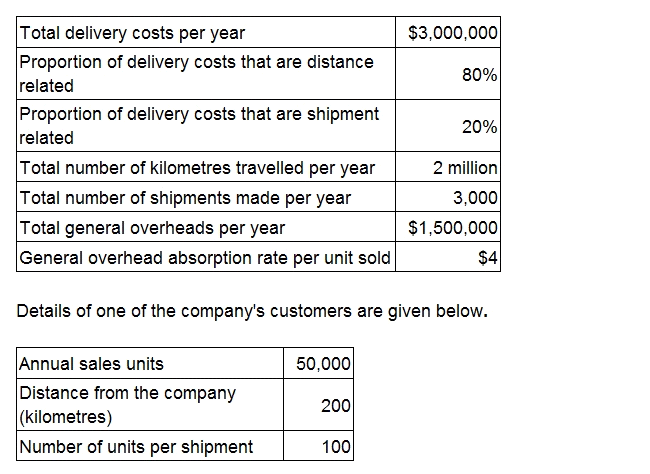

A large company that sells a single product has many customers. The contribution per unit of the product is $40. Data for the company as a whole are given below.

Using customer profitability analysis, what is the total annual profit for this customer?

Correct : A

Start a Discussions

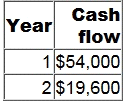

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

See Below Explanation:

Correct : A

Start a Discussions

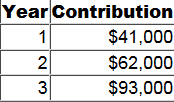

A company is considering investing $150,000 in a project which will generate the following contributions during the first three years.

Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises.

To the nearest $10, what is the forecast total project cash flow in year 3?

Correct : A

Start a Discussions

Which of the following statements is TRUE about the activity based costing system when compared to absorption costing method?

Correct : C

Start a Discussions