Master CIMAPRA19-F03-1 Exam with Reliable Practice Questions

BBA is a wholly owned subsidiary of AAB BBA operates in country B where the currency is the B$.

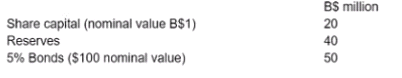

The following is an extract from BBA's financial statements at 31 December 20X1:

The following Information is relevant:

" The bonds were trading at $110 per $100 on 31 December 20X1. "Operating profit of BBA for the year ended 31 December 20X1 was S15 million

* The P/E ratio is 8

* Corporate income tax rate is 20%.

The tax authorities m country B Implemented thin capitalisation rules based on the level of gearing of the subsidiary, calculated as book value o( debt lo book value of equity The cut-off point for gearing used by the tax authorities for a company to be thinly capitalised is 75%.

Which of the following statements is correct as at 31 December 20X1?

Correct : C

Start a Discussions

A manufacturing company based in Country R. where the currency is the R$, has an objective of maintaining an operating profit margin of at least 10% each year

Relevant data:

* The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

* The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Correct : C

Start a Discussions

Which THREE of the following methods of business valuation would give a valuation of the equity of an entity, rather than the value of the whole entity?

Correct : A, B, D

Start a Discussions

Company WWW is considering making a takeover bid for Company KKA Company KKA's current share price is $5.00

Company WWW is considering either

" A cash payment of $5.75 for each share in Company KKA

" A 5 year corporate bond with a market value of $90 in exchange for 15 shares in Company KKA

Calculate the highest percentage premium which Company KKA shareholders will receive.

Correct : B

Start a Discussions

A national rail operating company has made an offer to acquire a smaller competitor.

Which of the following pieces of information would be of most concern to the competition authorities?

Correct : A

Start a Discussions