Master APA FPC-Remote Exam with Reliable Practice Questions

Which of the following forms is used by an employer to file an annual return of withheld FIT from nonwage payments?

Correct : D

Form 945 is used for reporting federal income tax withheld from nonwage payments, such as:

Pension distributions

Gambling winnings

Certain annuities

Form 941 (B) is for employment taxes on wages.

Form 940 (A) is for FUTA taxes.

IRS Form 945 Instructions

IRS Withholding Rules

Start a Discussions

The withholding of federal income tax is regulated by the:

Correct : B

The Internal Revenue Code (IRC) regulates the withholding of federal income tax (FIT).

FICA (C) governs Social Security & Medicare taxes.

FUTA (D) applies to unemployment tax but does not regulate withholding.

Internal Revenue Code (IRC) Section 3402

IRS Publication 15 (Employer's Tax Guide)

Start a Discussions

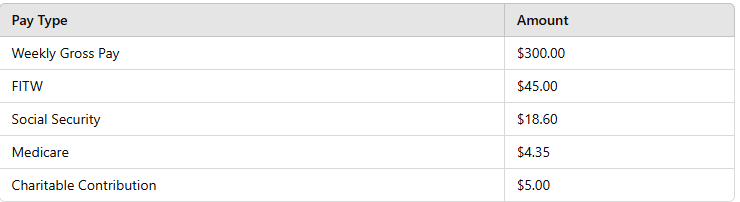

Under the CCPA, use the following information to calculate the MAXIMUM deduction for the child support order for an employee who is not supporting another family and not in arrears.

Correct : D

Step 1: Calculate disposable earnings

$300.00 - ($45.00 + $18.60 + $4.35) = $232.05

Step 2: Apply CCPA withholding limit

60% of $232.05 = $139.23

Consumer Credit Protection Act (CCPA) - Federal Child Support Withholding Limits

Payroll Withholding Compliance Guide (Payroll.org)

Start a Discussions

The MAXIMUM amount a 52-year-old employee can contribute to their 401(k) plan is:

Correct : C

In 2024, the 401(k) contribution limit for employees under 50 is $22,500.

For employees age 50 or older, an additional 'catch-up' contribution of $7,500 is allowed.

Total maximum contribution = $22,500 + $7,500 = $30,000.

IRS 401(k) Contribution Limits for 2024

Start a Discussions

Which of the following considerations is NOT needed when implementing a shared services environment?

Correct : C

System needs (A), processes affected (B), and cost of implementation (D) are critical factors in designing a shared services model.

Employee acceptance (C) is valuable but not a primary technical or financial consideration.

Payroll Process Improvement Guidelines (Payroll.org)

Start a Discussions