Master AICPA-Financial Exam with Reliable Practice Questions

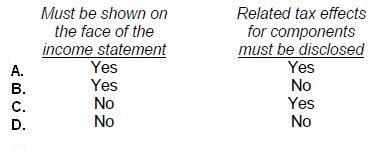

Which of the following is true regarding the presentation of "comprehensive income."

Correct : C

Choice 'c' is correct. No - Yes.

Comprehensive income may be shown on the face of a combined 'statement of income and comprehensive income' a separate section below net income, or in:

1. Separate 'statement of comprehensive income,' or as a

2. Component of the 'statement of changes of owners' equity.'

The income tax expense or benefit allocated to components must be disclosed, either on the face of the statement or in notes to the statement.

Choices 'a', 'b', and 'd' are incorrect, per the above rules.

Start a Discussions

Reclassification adjustments must be shown in the financial statement that discloses comprehensive income:

Correct : C

Choice 'c' is correct. Reclassification entries may be necessary to avoid double counting an item previously reported as comprehensive income (i.e., unrealized gain), which are now reported as part of net income (i.e., realized gain).

Choice 'a' is incorrect. The classification of assets as current or non-current has no bearing on reporting comprehensive income.

Choice 'b' is incorrect. All items of comprehensive income must be shown net of the related tax effects, but it is not done with reclassification adjustments.

Choice 'd' is incorrect. Transactions with shareholders such as paying dividends and issuing capital stock are not included in comprehensive income, thus, reclassification adjustments are not necessary to exclude them.

Start a Discussions

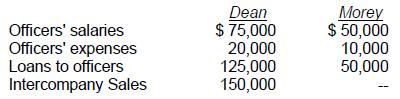

Dean Co. acquired 100% of Morey Corp. prior to 1989. During 1989, the individual companies included in their financial statements the following:

What amount should be reported as related party disclosures in the notes to Dean's 1989 consolidated financial statements?

Correct : C

Choice 'c' is correct. The only related party transaction that would require disclosure (assuming that all amounts are material to the financial statements) would be the loans to officers since they are outside of the ordinary course of business.

Choices 'a', 'b', and 'd' are incorrect. Officers' salaries, officers' expenses and intercompany sales (between entities included in a consolidated set of financial statements) are all transactions in the ordinary course of business and generally would not require disclosure.

Start a Discussions

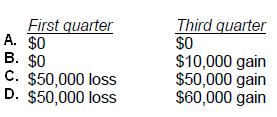

Wilson Corp. experienced a $50,000 decline in the market value of its inventory in the first quarter of its fiscal year. Wilson had expected this decline to reverse in the third quarter, and in fact, the third quarter recovery exceeded the previous decline by $10,000. Wilson's inventory did not experience any other declines in market value during the fiscal year. What amounts of loss and/or gain should Wilson report in its interim financial statements for the first and third quarters?

Correct : A

Choice 'a' is correct. Temporary market declines in inventory need not be recognized at interim when a turn-around can reasonably be expected to occur before the end of the fiscal year.

Start a Discussions

During the second quarter of 1988, Buzz Company sold a piece of equipment at a $12,000 gain. What portion of the gain should Buzz report in its income statement for the second quarter of 1988?

Correct : A

Choice 'a' is correct. $12,000.

Rule: The entire amount of an 'extraordinary gain or loss' or an 'unusual or infrequently occurring item,' e.g., a gain or loss from sale of fixed assets, should be reported during the period (quarter) incurred.

Choices 'b', 'c', and 'd' are incorrect. The full gain should be reported in the second quarter when it occurred.

Start a Discussions