Master AAFM CWM_LEVEL_2 Exam with Reliable Practice Questions

Section C (4 Mark)

Read the senario and answer to the question.

Raman's company has made plans for the next year for a new project. It is estimated that the company will employ total assets of Rs. 900 lakh, 75% of the assets being financed by borrowed capital at an interest cost of 6% per year. The direct costs are estimated at Rs. 530 lakh. All other operating expenses are estimated at Rs. 95 lakh. The goods will be sold to customers at 150% of the direct costs. Income tax rate is assumed to be 30%. Calculate net profit margin and return on owners' equity.

Correct : B

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

Vinay wants to have 80% of the desired retirement corpus from his monthly savings from now itself. If he expects to earn 12% p.a. on these savings, how much amount should the couple save at the end of each month to achieve this target?

Correct : C

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

Assume Reena retires at the age of 60 years and invests her salary at 8% p.a.What will be the future value of Reena's salary at the time of her retirement if she saves her entire salary?

Correct : D

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

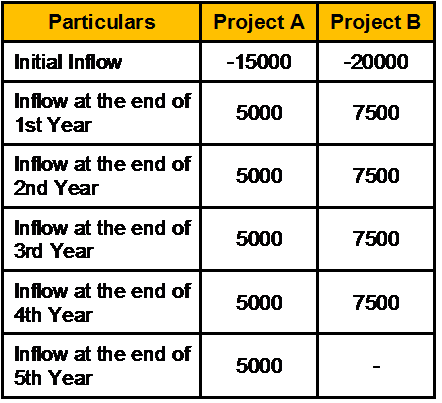

Vinay has come across two projects, each with a 12% required rate of return and under given cash flows:

If the projects are independent, you being a CWM would advise Vinay to:

Correct : D

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Adhikari bought agricultural land in Patna in 94-95 for 1.75 lakh. That land was vacant for last so many years. But due to establishing a ''Commercial Processing Zone'' the Bihar Government has issued a notice for compulsorily acquirement on 12/08/2003. In 2006 government has fixed compensation for Rs. 6.50 lakhs and acquired it on 09/01/2006. Rs. 2 lakh was received by Mr. Adhikari on 07/03/2006. Mr. Adhikari and others were not satisfied with the compensation and file a suit in the court.

Balance compensation paid by Bihar Government on 08/10/2008. The compensation is enhanced by another 1.50 lakhs by the Bihar Government which paid by the Government on 11/12/2008.Compute Capital Gain tax in the hands of Mr. Adhikari for the assessment year 2009--10.

Correct : C

Start a Discussions